On Oversight, Checks and Balances, and the County Budget

Our system of government imposes an arrangement of checks and balances, so no person or group can acquire unchecked power.

When it comes to the county budget, Florida statutes clearly designate the legislative body – the county commission, to have the authority and responsibility to set priorities for spending and taxation. The administrator and his staff prepare a detailed budget, following whatever guidelines they have been given, and the commission meets in the sunshine for two workshops and two public hearings to discuss and adopt a budget before the fiscal year begins on October 1.

WIth $4B at stake, a bureaucracy exceeding 11,000 people, and limited time available, the commissioners themselves cannot physically evaluate every line item in this very complex budget, so they focus on insuring adequate funding for their own public policy priorities while much of the budget travels on automatic. Lower level line items like specific road projects, nature centers, or other items with a constituency, only get discusssed if the staff recommends a substantial change to the item.

What does get discussed every year is the Sheriff’s budget, since it is the major consumer of tax dollars, and outside the control of county staff.

Most everyone will agree that the function of PBSO – law enforcement, the county jails and courtroom protection, is necessary and should be adequately funded. The agency should have modern equipment suitable to the mission, and deputies and staff should be adequately compensated in line with peer agencies around the state and in the rest of the country, and it is the Sheriff’s responsibility to request a budget that delivers what he needs.

But what if his request is excessive?

In the county departments, managers submit budget requests that are a mixture of needs and wish list items. It is the nature of organizations to want to grow. The Administrator and his staff must adjust the requests of his departments in creating the overall budget, so that spending growth (if any) fits within the revenue expectations of the organization as a whole. If the priorities are not in line with the Commission’s expectations, they are free to make adjustments as a part of the process. Not all wish list items are funded. Although the other Constitutional Officers have a similar autonomy to the Sheriff, they usually “play nice” with staff and their budgets are rarely controversial. They are also relatively small.

The Sheriff’s budget is different. It is very large and complex, and very little detail is available to staff or Commissioners, and certainly not the public without a chapter 119 (open Records) request. The attitude is one of arrogance – “this is what I need and I am not willing to discuss it further.” Since the PBSO request must fit within the overall county budget, big increases there crowd out other county spending and severely limit the ability of staff or Commission to be fiscally responsible. Since they are charged with approving the budget, the public typically blames them for the excessive tax increases that result.

This year, many of the Commissioners told us privately that they agreed the Sheriff’s budget is out of control. They know they are responsible for approving his spending, but see no effective way to challenge him. This has been true for many years, as Commissioners have come and gone. While it is true that they have the statutory authority to reduce his spending (subject to appeal to the Florida Cabinet), they do not feel they have the political basis to do so.

This year, only Vice Mayor Paulette Burdick and Mayor Priscilla Taylor have publically questioned the Sheriff’s spending. This takes courage and we appreciate what they have said and done.

As for the others, they are hostage to an impressive political machine that can bring enormous pressure on wavering commissioners from the districts where the Sheriff provides most of the law enforcement. Just witness the array of speakers at the September 8 hearing – HOA Presidents, concerned citizens, even PBSO employees – all came out to speak the Sheriff’s praises and remind the Commissioners what the price of resistance would be. One particular Commissioner went so far as to admit that without the support of the Sheriff, their re-election would be in doubt.

There are about 1.3 million citizens of Palm Beach County. Almost 900,000 are voters. Yet only a small number of people follow what happens at the county, and fewer still participate in the process. We believe that most of the county residents would be surprised at the size and growth rate of the Sheriff’s budget, but they are not organized, and lack the time and assistance to provide sufficient cover to those commissioners who would act if they could. By carefully limiting the size of his increases, the Sheriff assures that we never reach that tipping point that would so outrage the citizens that they would spontaneously rise in opposition.

Some Commissioners have suggested that next year can be different, but we doubt it. As long as the status quo goes unchallenged, or the funding mechanism for the Sheriff’s office is modified through statute or charter, the Sheriff will continue to claim whatever portion of the county budget he desires.

Transparency at PBSO – the Challenger’s View

At various times over the last two years, we at TAB have raised the issue of transparency regarding the Sheriff’s half billion dollar budget. Much of what goes on at PBSO is hidden from public view, and the budget is no exception. The only way to see how the agency spends the taxpayer’s money within the three “silos” of Law Enforcement, Corrections, and Court Services, is to file a chapter 119 (open records law) request and wait months for a partial answer. By contrast, the Martin County Sheriff puts all of his budget data right on his website for all to see. (see MSO Budget and Finance ).

Sheriff Candidate Joe Talley

Ethics also are not transparent at PBSO, and we believe that the Sheriff should voluntarily execute an interlocal agreement with the Office of Inspector General for oversight services equivalent to what we have for the county departments, the Solid Waste Authority, and the municipal governments. Commissioner Marcus pursued this avenue last year and was rebuffed. (See Should the Sheriff be Subject to the Ethics Ordinances and the Inspector General? ) “No way, no how” was the answer.

The County Commission created the Office of Inspector General in part to address our reputation as “corruption county”. The voters overwhelmingly voted to place the municipalities under her jurisdiction, and the SWA, Children’s Services Counsel and Health Care District came voluntarily. The Sheriff however, continues to resist.

Since Ric Bradshaw must stand for re-election to a third term this year, we wondered what his challenger Joe Talley had to say on these issues. Joe has recently announced his bid to lead PBSO, and brings a full career of law enforcement experience to the race, including 22 years in the Baltimore County Police Department where he attained the rank of major, and 5 years with the PBSO reserves. With this background he speaks from a position of authority on these matters. Here is what he had to say to us (emphasis is ours):

“… it is my view that the Sheriff is elected by the people. The Sheriff’s budget is money from the people. He is to administer that budget and the Office of the Sheriff as directed by the people…..the laws and the expressed wishes are from the people.

If the majority of the people vote to create an Inspector General, it is for a very good reason. To resist is like saying: “I am here now and you cannot touch me…I don’t care about the wishes of the people and I sure am not going to let the people see how I am spending their money”. What part of that kind of attitude works for a thinking citizen/taxpayer?

Is not the average taxpayer now thinking that perhaps there may be some very good reasons (or bad reasons) why they are being kept in the dark and the Sheriff is being defiant?

Perhaps, if we could see all the documents that have been requested over many months (and few have surfaced and then wrong ones or partial ones) the public would be less than pleased at the reckless and undisciplined spending inside the PBSO..

If elected, I will shine the bright light of day on the PBSO budget and answer all concerns of the public or the County Commission or special interest groups or students or anyone – because the citizens deserve answers. The budget will get a review by the County Commission and I will invite the Inspector General into PBSO warmly. I will have nothing to be afraid of and nothing to hide.

There is so much dysfunction inside PBSO and the employees are so distracted by the need to keep looking behind them, the citizens are getting short-changed at the moment.”

We think this is a refreshing attitude from one seeking the job of County Sheriff, and we hope his candidacy begins a public dialogue on these issues. A Sheriff should cooperate with the County Commission and the other constitutional officers and be a responsible steward of the public trust. Maybe the dialog of the 2012 elections can move us in that direction.

Tax Rate Proposal Still Too High

The current proposed millage on the table for the 2012 budget is $4.79 per thousand dollars of valuation, up 0.8% from the $4.75 of last year. With declining valuations, that millage would collect $596M in taxes, $7M or about 1% less than last year. An “alternative” offered by Bob Weisman differs by about $700K – hardly worth mentioning.

At the September 13 preliminary hearing, commissioners Abrams, Burdick and Marcus voted against the rate increase and were in favor of further reductions in the Sheriff’s budget. At $467M, it is down slightly from last year, but not as much as the estimated $19M he is saving from pension reform which requires contributions from employees for the first time. The other four commissioners (Aaronson, Santamaria, Taylor, Vana) declined to challenge the Sheriff in any way, and thus there were not enough votes to even discuss this prospect.

There are three major components to the county budget – county departments, Fire/Rescue, and the Sheriff’s Office.

In the last 9 years, the county departments grew fat on the rising real estate bubble, but have cut their tax requirements significantly since the peak in 2007 and are now only about 3% over what they were in 2003.

Fire Rescue grew and stayed high (up 70% since 2003) but this year they are not increasing the tax rate and have reduced spending by about $4M. They are also negotiating in good faith with the IAFF to avoid across the board raises in the next contract and reduce starting salaries 22%.

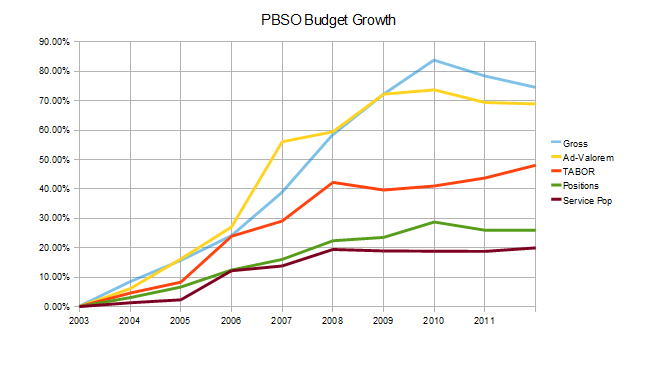

PBSO on the other hand, at almost $400M, is almost twice the county department’s ad-valorem requirement, up from close to parity a decade ago. (See graph below) There is very little the commissioners have been able to do about this balloon in public safety spending. At the first hint of cuts, the Sheriff threatens neighborhood groups with reductions in patrols or the closing of a substation and they bring enormous political pressure on the individual commissioners. As an independently elected constitutional officer, the Sheriff has autonomy in how he spends his budget, but the county commissioners are empowered to set his bottom line. Typically, no commissioners have seriously challenged the Sheriff, but this year we see a change. Newly elected commissioner Paulette Burdick does not seem to be afraid to ask the right questions and suggest that the Sheriff share the cuts with the county. Neither does commissioner Abrams. Commissioner Marcus, not too much of a PBSO critic in the past, has joined the other two in challenging the PBSO budget this year, to her credit. What is the matter with the other four? If there ever was an economy that called for across the board cuts, including in PBSO, this is it.

We call on Commissioners Aaronson, Santamaria, Taylor and Vana to think about the Taxpayer this year and show a little spine.

Only $5M in additional cuts are needed to avoid a rate increase. Cut the $5M from the Sheriff’s budget (1.25%) and you will be done. PBSO has become unaffordable at the current level.

We stand by the TAB Proposal for 2012:

- Don’t increase the tax rates

- Take the remaining cuts from the Sheriff

- Sell off unused property

- Use reserves where necessary

A Commissioner Takes on “Exigent Operational Necessity”

The Palm Beach Post is looking out for the taxpayer.

Last week we mentioned that Rhonda Swan raised the issue of the county’s interpretation of “exigent operational necessity” as it applies to the PBSO Career Services Act in an editorial.

This week, Jennifer Sorentrue brings it up in the context of the Sheriff’s budget dispute with the county, and quotes Steven Abrams: “It would seem to boil down to whether our current budget situation qualifies, Commissioner Steven Abrams said recently. “I personally believe it does.”

We know of one, perhaps two other commissioners who also differ with County Attorney Denise Neiman’s interpretation of the statute that “it is not necessity until the county is out of money”. Or, in the words of Ric Bradshaw: ‘The county would have to be “almost insolvent” before he could freeze employees’ pay, in his view. “If I was to freeze the pay plan, the union could come in here and take me to court,” Bradshaw said. “You can’t just violate the law because you want to.”

Will the commissioners push the issue? – we really hope so. The time has come for the Sheriff to tighten his belt like everyone else in the county – including the county staff who haven’t seen raises in quite a while.

For Jennifer’s excellent article, see: Palm Beach County, sheriff at odds over raises

Exigent Operational Necessity?

Writing in the Palm Beach Post on Friday, editorial writer and columnist Rhonda Swan makes the case that salary reductions for government employees in these troubled times are justifiable – even for administrators like Bob Weisman who takes home $251K / year.

She is also the first in the local media (to our knowledge) to raise questions about the Sheriff’s plan to give raises to the newly unionized civilian employees of PBSO. Citing the protection of the “PBSO Career Service Protection Act” – passed in 2004 to prevent a reduction in benefits for sworn law enforcement and corrections officers, Sheriff Bradshaw claims it now applies to the civilians.

The escape clause in the bill, “exigent operational necessity” has in the past been interpreted by County Attorney Denise Neiman as meaning “the county is out of money and the reserves are gone”. Ms Swan suggests an alternate view – that the Sheriff can invoke “necessity” within PBSO in light of county forced budget cuts. An innovative interpretation and we applaud the concept.

For the entire article, see: Administrators not immune

TAB is referenced in the article for our study on county pay and benefits.

Should the Sheriff be Subject to the Ethics Ordinances and the Inspector General?

Over the last few years, Palm Beach County has taken a great leap in establishing ethical standards and implementing a watchdog function that is helping dispel the reputation of “corruption county”. First, by ordinance, the County Commission and staff included themselves under the jurisdiction of a Commission on Ethics, and the Office of Inspector General. Then, in November of 2010, 70% of the voters supported a charter amendment to extend the umbrella to the 38 municipalities of the county, and the Solid Waste Authority brought themselves under it by inter-local agreement. By May of this year, the new ordinances (including a Code of Ethics and Lobbyist rules) were fully implemented.

There are still pockets of county government that are exempt from all this however. The school board is considering the question and may take the plunge at a later time, but the Constitutional Officers (Sheriff, Clerk, Tax Collector, Supervisor of Elections, Property Appraiser, County Attorney and Public Defender) are specifically excluded. The most significant of these of course is the Palm Beach Sheriff’s Office with its 4000 employees and $500M annual budget.

TAB believes if it is good for the county and cities, it should be good for the Sheriff, particularly given the wall that exists between PBSO and the public regarding disclosure of information. Very little financial (or other) information is readily available for scrutiny, and Chapter 119 (Open Records Law) procedures are needed to obtain anything not specifically mandated for disclosure under statute.

Just as the SWA took this step voluntarily, it has been proposed that the Sheriff enter into an inter-local agreement with the county to become part of the county ethics process. To this end, Chairman Karen Marcus formally requested that they do so.

“No Way, No How” was the synopsis of the 9 page response.

Responding for the Sheriff, Colonel Joe Bradshaw in the department of Legal Affairs, explained that they asked for a legal opinion from the General Counsel of the Florida Sheriff’s Association, R.W Evans. In Mr. Evans opinion, the “…County Code of Ethics cannot be applied to the Sheriff under any circumstances, because the investigation of law enforcement and corrections officers is preempted by Florida Law. Further, any oversight of the Sheriff’s Office by the Commission on Ethics and the Inspector General exceeds the County’s authority and improperly encroaches upon the constitutional office of the Sheriff.”

Based on this opinion, Colonel Bradshaw concludes “.. the Sheriff cannot enter into an interagency agreement with the county to extend the jurisdiction of the Palm Beach County Commission on Ethics and the Inspector General to the Palm Beach County Sheriff’s Office.”

In Mr. Evans response, he notes that “This issue is critically important to FLorida Sheriffs..” and that this is “.. the position of the Florida Sheriff’s Association of which I am General Counsel.”

In the opinion, several Florida Statues and case law are cited, pointing out that the Legislature has drawn a protective moat around law enforcement agencies which excludes interference from local elected officials in any way. In a sense, PBSO is “above the law” as far as the county is concerned and no public influence on PBSO is possible without changes in Legislation. We see this time and again – if the county asks the Sheriff for budget cuts he threatens to go to Tallahassee to overturn them. If existing benefits are questioned, the “PBSO Career Service Protection Act” is cited. There is effectively no local control over the Sheriff’s office save the ballot box.

Given the above, is there no other choice but to accept the opinion of the Sheriff’s Association? The voters of Broward County did not think so, and recently passed a charter amendment with 72% of the vote, placing their constitutionals (including the Broward Sheriff) under the County Code of Ethics. To date (to our knowledge), this has not been challenged in court on constitutional or other grounds, although Palm Beach County Attorney Denise Neiman has stated that Broward has crossed the constitutional line and a challenge would succeed. We shall see.

So what can be done about this? There are groups out there that are critical about the way PBSO spends taxpayer money (among other things – see pbsotalk.com). We have no way of knowing if information from those sources are accurate, but much of it appears to come from insiders. In fact, there is currently no outside oversight of PBSO such as the Office of Inspector General brings to other parts of county government, and we think that is a dangerous situation.

We support Chairman Marcus’ call for an inter-local agreement with PBSO. If there are legislative roadblocks then we should work through them with the delegation. We should also have a serious discussion of charter changes which would tear down the constitutional barriers to public oversight of PBSO.

For the full text of Colonel Bradshaw’s response to Karen Marcus, including the opinion of the Florida Sheriff’s Association, click HERE.

Pension Reform – the Final Bill

On Friday May 6, the conference committee put the final touches on FRS Reform and sent SB2100 to the Governor. Although it is not as far-reaching as the Governor wanted, it is significant, both in the precedent it sets (employees must now contribute to their pensions) and in the budget savings for both the state and the counties that participate in FRS.

The conference staff analysis summarizes the highlights of the bill as:

- All FRS members must now contribute 3% of their earnings to the system.

- For pension dollars accrued after July 1, 2011, the Cost of Living Allowance (COLA) of 3% is eliminated. (This is grandfathered in the bill in 2016, which leaves it up to a future legislature whether it will be restored. Sort of like the “Bush Tax Cuts”.)

- For participants who enter DROP after July 1, interest accrues at 1.3% instead of 6.5%.

Additionally, for those who enroll in FRS after July 1, 2011:

- “Average Final Compensation” (AFC) is the average of the highest earning 8 years (not 5).

- Vesting occurs after 8 years (not 5).

- Age and service requirements change to age 65 / 33 years (not 62/30) for regular class and to age 60 / 30 years (not 55/25) for special risk class.

To calculate the budget impact to the county, we must refer to the “employer contribution” section of the bill that starts on page 180 of the final conference amendment. The contributions are 3.28% of gross compensation for regular class, and 10.21% for special risk. (This compares with 9.63% and 22.11% this year).

That’s not the end of it though – the final amendment adds a section to “address the unfunded actuarial liabilities of the system” with an additional employer contribution of 0.49% and 2.75%, starting July 1 for regular and special risk, respectively. This amount then bumps up to 2.16% and 8.21% in 2012.

Taking these figures and applying them to our database of county employee compensation, finds that the county-wide savings in the first year would be $48M ($98M including the schools) and $26M in the next year. The first year savings breaks down as follows: $15.4M in county staff, $20.6M in PBSO, and $11.6M in Fire/Rescue.

The Florida Association of Counties has done a similar analysis state-wide and calculated that the savings for all counties would be $615M in the first year.

Pension Bills Ready for Conference

Much has happened to the two pension reform bills winding their way through the Legislature this week. Both Senate Bill SB2100 (replacing SB1130) and House Bill HB1405 have survived a vote (mostly along party lines) in their respective chambers. As there are differences between the bills, a conference committee will attempt to resolve them, probably starting next week. Although they do not go as far as the Governor’s original proposal (no change to special risk accrual for example), the changes are significant and it is expected that Governor Scott will support the result.

HB1405 requires an across the board 3% contribution from plan participants, increases the retirement age (for those entering the system after July) from 62 (or 30 years service) to 65 (or 33 years service), and terminates the DROP program starting in July. Special risk classes would see the retirement age go from 55 or 25 years of service, to 60 or 30 years. It does not change the 3% COLA. Employer contribution rates are set for 2012 at 6.16% for regular class and 16.95% for special risk, with a “surcharge” of .25% and 1.17% respecively to address the unfunded actuarial liability. Click HERE for the details of HB1405.

SB2100 requires an employee contribution that is tiered, starting with 2% for income under $25,000, 4% for income between $25,000 and $50,000, and 6% above that. Cost of living adjustments (COLA) are eliminated on a pro-rata basis, eliminating any COLA for accruals after July of this year. Like the house bill it ends the DROP program, but not until 2016. Retirement age is increased as in the house bill for all except the special risk class which is unchanged. The Senate bill also addresses the calculation of “Average Final Compensation” (AFC), excluding all but 300 hours of overtime from consideration, and allows only 500 hours of accumulated leave time that was earned prior to July of this year. Employer contribution rates are set for 2012 at 5.09% for regular class and 13.8% for special risk, with no “surcharge” for unfunded liabilities, although there is a section in the bill that allows for this to be added. Click HERE for details of SB2100.

From a Palm Beach County Perspective, both of these bills will result in significant savings. By using the stated employer contribution rates (compared to the current 9.63% and 22.11% special risk), we calculate savings between $23M and $40M in the county budget, and $28M to $39M to the school system.

The county is facing a significant budget hole this year with rising costs and decreasing revenue from non-ad valorem sources (including state and federal grants) and a projected 5% decline in property values. These FRS savings could go a long way to offsetting the need for a millage increase in the 2012 budget year.

For some analysis and political perspective on these bills see House Backs State Employees’ Pension Reform on Party Lines Vote and Florida Senate moderates public employee pension bill

The following table illustrates the differences between the Original Scott proposal and SB2100 / HB1405 in their current state.

| Current FRS | Rick Scott Proposal | SB2100 | HB1405 | |

|---|---|---|---|---|

| Accrual Rates | 3% special risk 1.6% general + 3 others |

2.0% special risk 1.6% all others |

NO CHANGES to current plan | NO CHANGES to current plan |

| Participant Contributions | None | 5% across the board | Tiered 0-$25K, 2% $25-$50K, 4% $50K+, 6% |

3% across the board |

| Defined Contribution Plan | Offered, with few takers | Only option for new hires | Only option for new hires after July except special risk class | NO CHANGES |

| COLA | fixed 3% / year | Eliminated for accruals past July 2011 (protects current retirees and accumulated benefits) | Eliminated for accruals past July 2011 (protects current retirees and accumulated benefits) | NO CHANGES to current plan |

| DROP Program | Continue working for 5 years while pension accumulates, then lump sum | Eliminated after July, 2011 | Eliminated after July, 2016 | Eliminated after July, 2011 |

| Retirement Age | age 62 / 30 years age 55 / 25 years (special risk) |

age 65 / 35 years age 55 / 25 years (special risk) |

age 65 / 35 years age 60 / 30 years (special risk) |

|

| Copyright 2011, Palm Beach County Taxpayer Action Board | ||||

The following chart illustrates the effect the Scott proposal would have on the county budget, compareed to the Senate and House bills. Maybe it is time for the taxpayers to remind our legislators why they were elected.

| Group | Number of employees | Average Salary | Scott Proposal Savings | SB2100 Savings | HB1405 Savings |

|---|---|---|---|---|---|

| County Staff | 5,731 | $45.9K | $13.2M | $11.9M | $8.5M |

| PBSO (general risk) | 1,808 | $53.0K | $4.8M | $4.4M | $3.1M |

| Fire/Rescue (general risk) | 208 | $85.0K | $0.9M | $0.8M | $0.6M |

| Schools | 20,986 | $41.3K | $43.3M | $39.3M | $27.9M |

| TOTAL (contr.) | 28,733 | $62.2M | $56.4M | $40.1M | |

| Governor 2% accrual | |||||

| PBSO special risk | 2111 | $77.7K | $20.3M | $13.6M | $6.5M |

| F/R special risk | 1303 | $88.6M | 14.3M | $9.6 | $4.6M |

| TOTAL (accr.) | 3414 | $34.6M | $23.2 | $11.1M | |

| TOTAL (both) | 32,147 | $96.8M | $79.6 | $51.2M | |

| Schools Only | 20,986 | $43.3M | $39.3M | $27.9M | |

| County Only | 11,161 | $53.5M | $40.3M | $23.3M | |

| Copyright 2011, Palm Beach County Taxpayer Action Board | |||||

NOTE: Assumptions are: 1) contribution savings = total payroll x contribution rate, 2) special risk accrual going from 3% to 2% would drop employer contribution from 23.25% to 15.5% over time (2/3). 3. Payroll is projected from 2009 data. Employer contribution rates from bill text used if available.

Pension Reform in Tallahassee – an Update

Breaking News:

Yesterday (4/1) the Senate budget committee introduced SB2100 as a committee bill, exceeding the provisions of SB1130 for pension reform. Including a 3% across-the-board contribution (replacing the tiered system of 1130), elimination of the DROP program, closing the defined benefit plan to new hires, and stopping the COLA for accruals (all after July of this year), it comes much closer to the Governor’s proposal than the earlier bill or even HB1405. (See SB2100 )

The bill text presents the employer contribution, effective in July, as 5.09% for regular class, and 13.8% for special risk (versus 9.63%/22.11% today). From this we can calculate that the savings to the county if the bill were to become law would be $42M ($82M with schools included).

It appears that it will exceed the $58M savings of HB1405 (which this week passed out of Appropriations essentially intact, much to the chagrin of the 40 or more police and fire union folks who showed up (in uniform) to oppose the bill. See House Committee Backs ‘Modest’ Pension Reform for State Employees

When last we looked at the House and Senate bills for FRS reform (Pension Reform and Implications for Palm Beach County), the House bill had not yet been introduced and the Senate bill, though a pale shadow of what the Governor wanted, at least offered some reform in the area of employee contributions.

Senate Bill SB1130 has now been passed out of Government Oversight and into the Budget commitee, and the provisions it maintained are really of no consequence to serious reform. From what we have been told, the employee union lobbyists descended on the Senators of the Government Oversight and Accountability Committee, outnumbering pro-reform forces by a large margin. The capitulation was total. Gone is any mention of accrual changes, and the employee contribution is tiered in such a way that few will pay more than pocket change. As a matter of fact, this bill has a provision that totally eliminates any employee contribution if the system returns to 100% funding. The requirement for new hires to be eligible for only the defined contribution plan remains, but only for those positions whose starting salary exceeds $75,000. Our TAB analysis of the impact to Palm Beach County indicates that this bill could actually cost the county $1.7M MORE than the existing pension scheme. Both of our Senators Bogdanoff and Benacquisto sit on this committee and voted for this extremely disappointing bill. Click HERE for the latest commitee staff analysis of SB1130.

HB1405 started out reasonably close to the Governor’s proposal, but has been weakened also. The 5% contribution has been dropped to 3%, there are no accrual class changes, and no mention is made of COLA adjustments or plan eligibility for new hires. It does still eliminate the DROP program after July of this year, but with a few committees yet to go, can this survive? The House bill does save money though – with a 3% contribution, the county could potentially see a $58M savings ($28M for county government not counting the schools.) Click HERE for the latest committee staff analysis of HB1405.

It was our understanding that the almost $4B budget hole was to be filled (in the Governor’s plan) with a contribution of $1B in savings from FRS. With an overwhelming majority in both houses, the Republicans in Tallahassee have the opportunity to accomplish real fiscal reform. This is not a very auspicious start. Hopefully, Governor Scott will not accept this faux reform and send the legislators back to the drawing board until they get it right.

The following table illustrates the differences between the Scott proposal and SB-1130 / HB1405 in their current state.

| Current FRS | Rick Scott Proposal | SB1130 | HB1405 | |

|---|---|---|---|---|

| Accrual Rates | 3% special risk 1.6% general + 3 others |

2.0% special risk 1.6% all others |

NO CHANGES to current plan | NO CHANGES to current plan |

| Participant Contributions | None | 5% across the board | Tiered 0-$40K, 0 $40-$70K, 2% $70K+, 4% |

3% across the board |

| Defined Contribution Plan | Offered, with few takers | Only option for new hires | Only option for new hires with starting salary > $75K | NO CHANGES |

| COLA | fixed 3% / year | Eliminated for accruals past July 2011 (protects current retirees and accumulated benefits) | NO CHANGES to current plan | NO CHANGES to current plan |

| DROP Program | Continue working for 5 years while pension accumulates, then lump sum | Eliminated after July, 2011 | NO CHANGES to current plan | Eliminated after July, 2011 |

The following chart illustrates the effect the Scott proposal would have on the county budget, compared to the Senate and House bills. Maybe it is time for the taxpayers to remind our legislators why they were elected.

| Group | Number of employees | Average Salary | Scott Proposal Savings | SB1130 Savings | HB1405 Savings |

|---|---|---|---|---|---|

| County Staff | 5,731 | $45.9K | $13.2M | -$0.3M | $9.1M |

| PBSO (general risk) | 1,808 | $53.0K | $4.8M | – $0.1M | $3.3M |

| Fire/Rescue (general risk) | 208 | $85.0K | $0.9M | $0.0M | $0.6M |

| Schools | 20,986 | $41.3K | $43.3M | -$1.1M | $30.1M |

| TOTAL (contr.) | 32,147 | $62.2M | -$1.5M | $43.1M | |

| Governor 2% accrual | |||||

| PBSO special risk | 2111 | $77.7K | $20.3M | -$0.1M | $8.5M |

| F/R special risk | 1303 | $88.6M | 14.3M | -$0.1 | $6.0M |

| TOTAL (accr.) | 3414 | $34.6M | -$0.2 | $14.5M | |

| TOTAL (both) | $96.8M | -$1.7 | $57.6M |

NOTE: Assumptions are: 1) contribution savings = total payroll x contribution rate, 2) special risk accrual going from 3% to 2% would drop employer contribution from 23.25% to 15.5% over time (2/3). 3. Payroll is projected from 2009 data. Employer contribution rates from bill text used if available.

Pension Reform and Implications for Palm Beach County

Highlights

- Governor’s FRS reform worth close to $100M / year to Palm Beach County (with schools included)

- Senate bill SB1130 implements only portions – reducing savings to about $30M

- Any change in special risk accruals are strongly opposed by the police and fire unions

- The legislature lacks the political courage to support the governor in these changes

With the legislative session about to open, a battle is brewing over the Governor’s budget. (See “Budget Brawl set to get under way Tuesday” in the Sun Sentinel)

Extremely piqued over Scott’s rejection of the federal rail grants, which will likely stand now that the Supreme Court has rejected the legal challenge brought by Senators Altman and Joyner, the Senate is ready to rumble. How will the Governor’s budget fare? “Dead on Arrival” is how Budget and Tax Subcommittee Chair Ellyn Bogdanoff describes it.

The state budget affects those of the cities and counties in Florida, as grant money for things like transportation infrastructure and community services is cut. The most dramatic effect for Palm Beach County though would be in the area of pension reform. Unlike the cities, which mostly have their own pension plans, county employees, including PBSO, Fire/Rescue, as well as the employees of the school system participate in FRS – the state run Florida Retirement System.

Currently, FRS enrollees pay nothing to participate, accrue benefits at a rate of 1.6% for each year worked (3% for special risk classes such as police and fire), receive 3% cost of living increases every year they are retired, and can start collecting benefits after 30 years (25 years for special risk). The Governor has proposed requiring a 5% contribution, ending the cost of living adjustments, and reducing special risk accruals to 2% / year (for benefits accrued after July of this year).

When Governor Scott rolled out his template for FRS changes, we at TAB mapped them against the Palm Beach County workforce makeup (number of special risk enrollees, size of payroll, etc.) to estimate the financial impact to the county budget. Our estimate of approximately $55M (plus another $43M in the schools) assumed a 5% contribution by all employees, and a reduction in the special risk accrual rate from 3% to 2% for the approximately 2,100 PBSO and 1,300 Fire/Rescue employees in that class. Since any county savings from FRS changes may be offset by reductions in revenue sharing, it is not clear at this time what the net effect would be, but the budgeted appropriations for personal services would be significantly reduced. (See chart below)

Let’s put that number in perspective. In the coming fiscal year 2012, property valuations are expected to decline about 5%, while personal services costs are rising and federal and state grants are declining. The county estimates that the shortfall, if the millage were held flat (4.75 for the county-wide millage), will be in the $50-60M range – approximately the size of the savings that Scott’s FRS changes would bring.

Since that time, the county folks who track this stuff told us that the changes were unlikely to happen. They predicted (accurately as it has turned out so far) that the legislature will lack the political will to stand by the governor in such a radical change.

The Senate bill taking up FRS reform, introduced on February 15 by Senator Jeremy Ring (Democrat, Broward District 32), who chairs the Governmental Oversight and Accountability Committee, is SB1130, “Retirement”. A companion bill that addresses municipal pensions not covered by FRS is SB1128, “Public Retirement Plans” The companion house bill H0303 was withdrawn prior to introduction.

It should be noted that as of today the session has not begun and there are already 8 amendments to SB1130. It will remain a moving target and could possibly be improved as it moves through the committees.

SB1130 introduces an employee contribution component, but currently does not specify the percentage. (Several media reports have listed it at 2% but the bill is silent at this time.) COLA, special risk accruals, elimination of the DROP program and other aspects of the Governor’s proposals are noticeably absent from the bill. The bill does adopt the Governor’s proposal to close the defined benefit plan to new participants (in favor of a 401(a) type plan) after July of this year. The Sun Sentinel reported it thus: “Public employee unions, especially politically powerful police and firefighter groups, have strongly protested — and lawmakers seem to be listening”.

This table illustrates the differences between the Scott proposal and SB-1130

| Current FRS | Rick Scott Proposal | SB-1130 | |

|---|---|---|---|

| Accrual Rates | 1.6% general 3% special risk |

1.6% general 2% special risk |

NO CHANGES to current plan |

| Participant Contributions | None | 5% across the board | 2% across the board |

| Defined Contribution Plan | Offered, with few takers | Only option for new hires | Only option for new hires |

| COLA | fixed 3% / year | Eliminated for accruals past July 2011 (protects current retirees and accumulated benefits) | NO CHANGES to current plan |

| DROP Program | Continue working for 5 years while pension accumulates, then lump sum | Eliminated after July, 2011 | NO CHANGES to current plan |

On Saturday, Senate President Mike Haridopolis visited a meeting of the grassroots group “DC Works for Us” in Coral Springs. During the Q&A, we asked him about this seemingly tepid response to the Governor’s reform proposals. In response, he said that the legislature does intend to pass FRS reform this year, with an employee contribution of “maybe 2-3%”, but when asked about the special risk accrual he replied that it was “not fair to cut back on something that was promised to our employees”.

We feel this answer is disingenuous, since the proposal is not a takeaway of existing benefits that have accrued, only a change to future accruals. Furthermore, since the original intent of special risk class was to allow employees in physically demanding jobs to retire at 25 years with equivalent pensions to 30 year normal retirees, a 2% accrual already exceeds that measure.

Since special risk applies mostly to police and fire, both of which have strong unions who operate very effectively in Tallahassee, it is clear that Florida is not Wisconsin – at least as far as the Senate is concerned. Since Senator Haridopolis has announced a bid for the US Senate, I guess it is not surprising that he doesn’t want to take on the PBA and IAFF.

The following chart illustrates the effect the Scott proposal would have on the county budget, and how very little of those savings have made it into the Senate bill. Maybe it is time for the taxpayers to remind our legislators why they were elected.

NOTE: Assumptions are: 1) contribution savings = total payroll x contribution rate, 2) special risk accrual going from 3% to 2% would drop employer contribution from 23.25% to 15.5% over time (2/3). 3. Payroll is projected from 2009 data.

| Group | Number of employees | Average Salary | Governor 5% contribution | SB1130 2% contribution |

|---|---|---|---|---|

| County Staff | 5,731 | $45.9K | $13.2M | $5.3M |

| PBSO | 3,919 | $66.3K | $13.0M | $5.2M |

| Fire/Rescue | 1,511 | $88.1K | $6.7M | $2.7M |

| Schools | 20,986 | $41.3K | $43M | $17.3M |

| TOTAL (contr.) | 32,147 | $75.9M | $30.5M | |

| Governor 2% accrual | SB1130 no change | |||

| PBSO special risk | 2111 | $77.7K | $12.6M | 0 |

| F/R special risk | 1303 | $88.6M | 8.9M | 0 |

| TOTAL (accr.) | 3414 | $21.5M | 0 | |

| TOTAL (both) | $97.4M | $30.5 |