2014 County Budget – What To Expect

Next week, county staff will be unveiling their 2014 budget proposal to be discussed at the June 11 budget workshop at 6pm in the Commission Chambers. TAB will analyse the proposal when it is published, but what do we know now and what can we surmise?

- Property valuations are up this year by 3.7%, from $125.1B to $129.7B, according to Property Appraiser Gary Nikolits. See Tax base grows in Palm Beach County, 34 of its 38 cities.

- Using last year’s millage rate of 4.7815, this would produce approximately $620M in county-wide ad-valorem revenue, up about $20M over last year’s budget.

- The Sheriff’s Budget Proposal is requesting $510M – up $38M or 8.3% over last year. This request includes a 2% across the board “cost of living” increase for all employees, in addition to raises already included via contract. (The personal services budget is up over 6%). It also includes $3M targeted for mandated expenses associated with Obamacare.

- Interest from the county’s investments are down about $10M.

- The Solid Waste Authority (whose governing board is made up of the current county commissioners), gave their employees a 3% increase already (pre-budget), as have some municipalities. (See: Raises approved for Solid Waste Authority employees, after three years of frozen pay) It would seem likely that Administrator Weisman would like to do the same for his employees.

- Reserves have been spent down slightly in recent budget years and both county staff and county Comptroller Sharon Bock would like to begin rebuilding these reserves.

- Infrastructure spending, particularly on roads and bridges, has been deferred in recent years and is a priority for some commissioners.

So what can we gather from all this?

Although many would suggest that rising valuations present an opportunity to lower millage (much as millage has been raised as valuations declined), the combination of upward pressure on spending for raises and infrastructure and reserve replenishment, combined with lower revenue from investments, would seem to suggest the opposite. The Sheriff’s request alone will swamp the additional revenue expected from higher valuations.

We have turned a corner, and the valuation declines that have driven the budget since 2008 have bottomed and are now rising. This suggests a different dynamic. Besides the points already mentioned, you should expect that many special interest groups will come forward to claim a piece of the “windfall”, making for a possible feeding frenzy.

TAB believes that in recent years, the county has done a reasonable job in facing economic reality, and the additional revenue this year at flat millage could be used to relieve some of the pressure. Raising the millage rate in the face of improving conditions would be unwise however. If we have truly turned a corner, there will be revenue available in the coming years and some gratification should be deferred.

County Administrator Bob Weisman’s Outlook for 2014 Budget

On Thursday March 28, the County Budget Task Force of the Town of Palm Beach, a TAB coalition partner, chaired by Mayor Gail Coniglio, hosted County Administrator Bob Weisman, OFMB Director Liz Bloeser and Budget Director John Wilson for some insight into the coming budget cycle.

Robert Weisman

After several years of increasing millage, last year was significant in that the millage was unchanged, and the slight (0.7%) uptick in valuations after 5 years of declines yielded a few million more in revenue. Although it is still early, the departments have not done their budget estimates, and the Sheriff (2/3 of the ad-valorem county-wide budget) will not make his request until May, Mr. Weisman intends to seek flat millage once again. (Note: With the property appraiser’s early forecast at + 1.5%, that could generate an additional $9M in property taxes.)

In a wide-ranging presentation, the Administrator highlighted some situations that have bearing on the 2014 budget:

- The communications workers and transit workers (Palm Tran) unions were offered a small increase for September but are holding out for more. The county does not plan to change their offer.

- The Palm Tran worker’s pensions are in a separate plan from FRS (Florida Retirement System) used by the rest of the county, and are underfunded. The county is on the hook for $9M ($3M per year for three years) to increase its funding level.

- His general instruction to staff departments is to hold the line – no refill of vacant positions again this year.

- The Sheriff (as usual) is the biggest variable, spending $400M (mostly on employee pay and benefits), compared to $270M for the county staffs.

- Fire Rescue is about to conclude a new contract next month, for two years with no increases and 3% in the third year. New hire salaries will be reduced going forward, although there have been no new hires in four years. The contract will be less expensive than the previous period.

- Clerk Sharon Bock, who is in charge of the county investment portfolio has shifted much of the balance from relatively high performing instruments (primarily mortgage backed Frannie Mae securities) to short term bonds. This reflects a changing outlook on the future economy (presumably higher interest rates), but will present a shortfall in portfolio earnings this year.

- The Mecca Farms deal with the South Florida Water Management District appears to be dead. The $30M offered is less than the property is worth, and conditions have changed in two years. With Vavrus likely to be developed next door, Mecca may be worth something closer to the $60M that was paid for it, and several developers have approached the county to discuss options.

- Overall debt levels (and carrying costs) are declining.

- Supervisor of Elections Susan Bucher has under spent her budget and returned a million or so.

- The sequestor will affect the county in two areas – Head Start and Senior Services (meals, etc.) By eliminating bus service for the Head Start students, they can absorb the cuts without reducing the program.

- A relatively new expense going forward is $5M per year for the Homeless Resource Center, off-budget at inception but strongly supported by the Board of Commissioners.

The meeting was upbeat and provided a good snapshot at this point in the cycle, and was much appreciated by the task force members.

Some dates to keep in mind: On May 1, the Sheriff will deliver his budget request. On June 1, the Property Appraisor will have his estimate of valuations. Then on June 11, the first budget workshop will take place at 6:00pm in the commission chambers, 301 North Olive.

Final 2013 Budget Adopted

Last evening, at the final hearing on the 2013 county budget, a 4.7815 millage rate was adopted, unchanged from last year.

Compared to the contentious budgets of the last three years, where rates went up 14.9%, 9.3% and 0.7% respectively, this was a pleasant change. Missing was the Kubuki dance by the program constituents whose perogatives were threatened, the standoffs between the Administrator and the Sheriff, and battles with taxpayer advocates over the millage rate, the use of reserves, and the potential sale of county property to make ends meet. Some funds were even restored to address road maintenance that has been routinely deferred.

In a presentation by Bob Weisman at the last budget hearing earlier in the month, the trend in ad-valorem equivalent spending was shown to have converged on the “TABOR” line – that measurement of population growth and inflation that is a gauge of “acceptable” spending growth. What that means is that if spending had risen only as fast as inflation and the expanding population since 2003, the spending level would be what it is today. Of course the fact that spending was quite a bit above that line for most of the period indicates that in good times, restraint is hard to find.

Much of this spending restraint came at the expense of the county departments, as the “gorilla in the room” is the PBSO budget which at almost $480M has grown over 70% since 2003. With 83% of that figure tied to salary and benefits, expect much discussion of that figure going forward.

TAB has typically been critical of the budgets of recent years, but this year we are satisfied that flat millage without significant program cuts was appropriate. Going forward though, as housing recovers and valuations start up again (they bottomed this year), we will remain vigilant, and hope that the “TABOR” discipline has caught on. With Commissioner Santamaria already calling for raises for all employees, we shall see.

Here are the Post and Sun-Sentinel accounts of the meeting:

- Palm Beach County approves $3.2 billion budget, holding tax revenues steady

- Palm Beach County avoids property tax increase

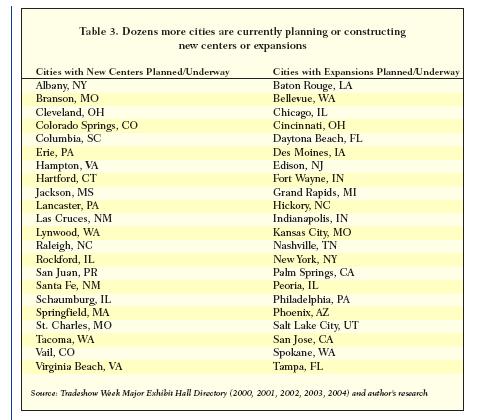

In the following graph, the dotted line represents “TABOR” – indicating that population and inflation supported a 36% cumulative growth in spending. As you can see, ad-valorem spending has come down to that line, with valuations and adopted tax leveling off. The decline in gross spending seems to be influenced by a sharp dropoff in “intergovernmental” revenue – federal and state grants and the like. That category fell to $391M from $523M in 2012.

What’s Going On with Convention Centers and HQ Hotels? Part 1 of 3

This is the first in a three-part series about Convention Centers and HQ Hotels. The first two entries cover the general topic of publicly subsidized Convention Centers. The third will be a specific look at what is being proposed for Palm Beach County’s Convention Center HQ Hotel to examine the ‘induced’ demand and perhaps ask some questions that we wished the County Commission had asked.

What is different about Palm Beach County/West Palm Beach versus most of the other cities listed is the apparent lack of opposition amongst the Commissioners and WPB City Council, as well as from the private sector. The business community seems to be as eager as the government entities involved to spend tax-payer dollars, all assuming that it is a win-win for them. Perhaps – but it is definitely not clear that the projected Economic Impact is real; just as it is unclear whether the risk to the tax-payer may exceed the benefits to the community.

If nothing else – this series will serve as documentation. When ‘down the road’ the optimistic results do not meet projections and the tax-payer is once again asked to bear the brunt of future expansions, renovations or new facilities – we can go back to these articles and say ‘we told you so’. If the results are wildly successful – we’ll be happy to ‘eat crow’. Readers – tell us who the odds favor……?

PBCTAB is late to the game as we first heard about the Convention Center HQ Hotel a year ago, and then had short notice prior to the July 24th, 2012 Workshop where it was decided to proceed with a County subsidized Convention Center HQ Hotel.

While conventional (sic) wisdom says that of course one should have a HQ hotel next to a convention center (A County Funded Hotel – Who Wins?), does the supposed induced demand in conventions due to the proposed HQ hotel justify the spending of taxpayer dollars? West Palm Beach and Palm Beach County are not alone. There are many cities considering, in process or completing HQ hotels. All of these use the same arguments and analyses.

The myriad cities all:

- are told by X, Y, Z trade show associations that they were not picked because of lack of HQ hotel (or their HQ hotel was not adequately sized) and are presented with videos by those associations describing how they would have picked that city otherwise

- use the same 1-3 consultants to justify their proposal to use public funds

- say that they have unique and desirable features that will bring the conventioneer to their city

- estimate a large increase in attendance based upon the addition of the HQ hotel or addition and an associated increase in employment and associated economic impact by those direct jobs and indirect spending by the visitors

- do not put measurements in place to assure that the projections are met

- do not achieve the desired outcome

- then have to ‘update’ their convention center, their HQ Hotel, their ‘City Place’ equivalent or add an arena.

We sent the Commissioners an article entitled “The Convention Center Shell Game” from 2004. But has anything changed since then? Steve Malanga, author of the quoted piece, writes this in a January 2012 piece:

“The convention business has been waning for years. Back in 2007, before the current economic slowdown, a report from Destination Marketing Association International was already calling it a “buyer’s market.” It has only worsened since. In 2010, conventions and meetings drew just 86 million attendees, down from 126 million ten years earlier. Meantime, available convention space has steadily increased to 70 million square feet, up from 40 million 20 years ago.”

Several of the Commissioners have quoted from Governing magazine in the past. The following quotation is from an article from the magazine, entitled “Needed: Better Benchmarks for Convention Investments” in July 2011. The emphasis is ours.

“The national supply of convention exhibit space has increased by more than 70 percent over the last 20 years, but the past decade hasn’t been kind. According to the now-defunct industry publication Tradeshow Week, attendance at conventions, trade and consumer shows decreased from 126 million in 2000 to 86 million in 2010.

Even such industry leaders as Las Vegas, Orlando, Atlanta and Chicago saw business decline after completing expansions in recent years, according to Prof. Heywood Sanders, who tracks the convention industry. Some opened their expanded facilities during a recession, but all saw business drop.

With hotels–particularly the large, moderately priced kind convention planners favor–proving increasingly difficult to finance, many industry insiders are blaming the downturn on a shortage of rooms proximate to convention centers. The response has been a spate of publicly owned or subsidized hotel development.

But that hasn’t cured what ails the industry. Convention hotels in Baltimore, Austin and Phoenix are doing poorly, and St. Louis’ convention headquarters hotel is in foreclosure.

Nonetheless, a 1,167-room headquarters hotel just opened in Washington, D.C., and Philadelphia recently unveiled a $787 million convention-center expansion. Convention and/or hotel expansions are also underway in Dallas, Detroit, Indianapolis, Nashville and Orlando.”

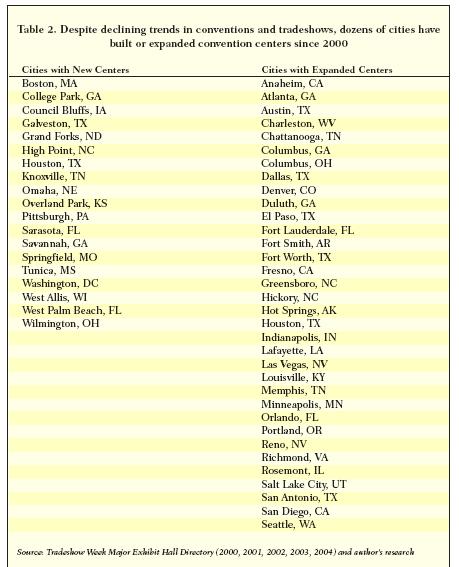

Dr. Heywood Sanders, Professor at University of Texas, San Antonio, wrote a research brief published by the Brookings Institution in 2005, entitled Space Available: The Realities of Convention Centers as Economic Development Strategy. Sanders’ expertise is in Public Policy and he is sought by citizens from cities across the country to testify to the folly of their government’s proposed expenditures. While the professor may have his detractors (primarily cities forging ahead with plans and those consultants used to justify those plans) – the following two charts from his 2005 study show the sheer number of convention center upgrades in the works during the last 10 years:

and

Meanwhile – the studies used by our own Palm Beach County administration shows a chart, Figure 5, of similarly sized, publicly subsidized hotels with the dates they were due to open.

Source: Public Participation in Hotel Development Prepared by HVS Convention, Sport& Entertainment Facilities Consulting, November 3, 2011.

These above are only a list of similarly sized hotels and do not represent all of the additional room nights being added throughout the country. The leading convention centers areas, such as Orlando, and Las Vegas are dealing with the economic realities by packing in multiple simultaneous events into their huge centers – thus taking demand from the second and third tier markets.

This mature and declining industry cannot possibly absorb all of the additional space nor achieve the positive economic impacts and occupancy projections made to the cities by consultants and by the cities to justify expenditure of public monies.

Our next article will examine recent developments related to publicly subsidized Convention Centers and HQ Hotels around the country.

- Throwing good money after bad – Convention Center headlines from cities across the country – Part 2 of 3

- The tax will generate over $100 million annually

- It will partially shift transportation funding to ‘tourists’

- State Statute allows for the tax and PBC is one of the few of the 67 counties that don’t charge this sales tax.

- This is a tax increase. It affects most purchases and services. And unlike the fire/rescue sales surtax proposed to the Commission in 2010, it makes no claims that it will be revenue neutral nor is it accompanied by any decrease in ad valorem

- This tax would be permanent. Unlike the recently expired school sales tax, this tax is not for a specific set of projects nor does it have an end date.

- This will be a revenue windfall for the county. We remain in an economy close to recession. Inflation is already here in our fuel and food prices, and will continue to increase.

- There is no accountability. The spending isn’t subject to any board, nor does the county have any performance or productivity benchmarks.

- Local option gas tax: 6 cents on every gallon of gas for exactly the same purpose as this proposed except debt service

- The ‘ninth’ cent tax, 1 cent tax on every gallon of gas that lists all the same purpose

- County Gas Tax: 1 cent on every gallon of gas to be used on transportation related areas

Some Background to the Mecca Farms Proposal

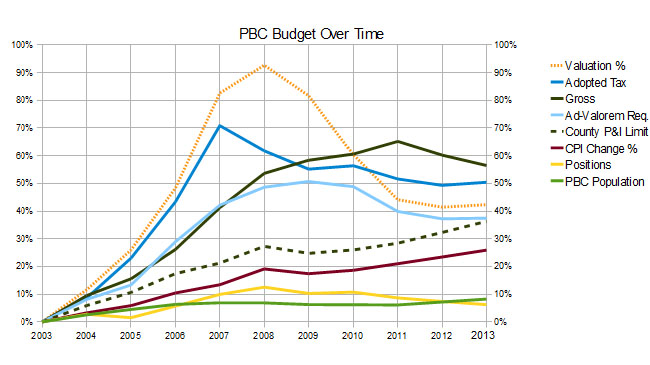

As the BCC considers the possible sale of the Mecca Farms property to the South Florida Water Management District, it is useful to consider the history of this site, and its relationship to the Vavrus Ranch which is just now being considered for development. (See: Blockbuster deal for Vavrus Ranch in the works)

The 1919 acre Mecca Farms, initially the preferred site for the Scripps Biotech industrial park, was to be accompanied by a residential development on the adjacent Vavrus ranch, presumably a “science ghetto” where the Scripps employees and their families would buy houses. Pushed by then Governor Jeb Bush and Commissioner Mary McCarty, the Business Development Board signed options for both parcels in 2003, prior to a final decision by Scripps. Scripps ultimately moved to their current Abacoa location when environmental lawsuits became a significant obstacle and a judge reversed the Corps of Engineers approval of the project.

According to Randy Schultz in the Post on May 25 (The best deal they’ll get):

Source:Sun Sentinel, 2/2005

As reported in the South Florida Business Journal in February of 2005, a division of Lennar held a joint option with Centex to buy Vavrus and planned 9-10,000 homes. The option was held by EDRI (Economic Development Research Institute), a nonprofit established by the BDB, who later transferred it to Lennar/Centex for $1.5M up front plus $51M on closing.

As reported in the Boca News on 8/3/2004, Mecca Farms itself was purchased by the county after a hastily convened meeting of four of the seven Commissioners voted 3-1 to proceed. Voting yes were Burt Aaronson, Karen Marcus and Mary McCarty, with Addie Greene voting no. The reason for the haste was that then Clerk Dorothy Wilkin was holding $1.4M of funds intended to clear the citrus trees off the site and the commissioners wanted to proceed.

Development got started early too, with Catalfumo Construction hired to build the roads on the site, and AKA services to build a 9 mile water pipe extension along SR7, 40th Street, 140th Street North and Grapeview Blvd. In total, the county spent $40M on planning and site prep and $51M for the pipeline, in addition to the $60M for the land.

The 2009 Grand Jury Report on public corruption in the county had this to say:

“The county eventually purchased the 2,000 acre Mecca Farms grove site for approximately $60 million dollars. Palm Beach County paid $30,000 per acre for land that credible evidence indicated was worth a maximum $10,000 to $15,000 per acre. With improvements to the site and area, the county expended approximately $100 million dollars to acquire and improve the Mecca site. Ultimately, Mecca Farms was never approved for development and the Scripps project was sited and built near Abacoa in Jupiter. Palm Beach County now owns and maintains at taxpayer’s expense the 2,000 acres of unimproved and undeveloped property known as the Mecca site.”

“The Mecca site transaction and other transactions lend credence to the perception of cronyism, unfair access and corruption of the land acquisition process. The Grand Jury repeatedly heard testimony of intense political pressure put on local government in land deals. Witnesses referred to the political atmosphere surrounding land deals as being a feeding frenzy.”

“The Grand Jury finds that a glaring deficiency in how land deals are handled by Palm Beach County is the overvaluation of property for purchase and undervaluation of property for sale or trade. A number of witnesses testified that when the county buys property, it overpays, and when the county sells property, it sells too cheaply. The Grand Jury examined a number of documents, received testimony and reviewed reports that support this buy high and sell low charge.”

The current offer for Mecca is $30M in cash plus about 1700 acres of land puported to be worth $25M. Mecca is appraised in the PAPA database at about $50M. The $30M cash is not sufficient to pay off the remaining $45M in debt incurred in the Mecca purchase (with $6.5M / year in debt service), nor will it recoup the $91M investment in infrastructure.

Vavrus is carried on the PAPA books as owned by WIFL, LLC. It is split into 11 parcels with a total 2011 appraisal of $68.5M and a taxable value of less than $1M.

With a Vavrus development now being considered, it would be helpful to know if the pipeline costs can be recovered by supplying the new development, and what affect (if any) a large development next to Mecca would have on its appraisal, and intended use by SFWMD for water storage.

The then ill-advised purchase of Mecca was rushed into without due diligence. Let’s not make the same mistake on its sale. In particular, let not a future grand jury say “..when the county buys property, it overpays, and when the county sells property, it sells too cheaply”.

Commissioners Cap Millage at Last Year’s Levels

The 2:15pm time-certain item 5A3 to set maximum millage for 2013 didn’t get going until well past 3:30 – but it was short and to the point.

County Administrator Weisman made it clear that the only topic that had to be discussed was the setting of maximum millage for the September hearings. No details of the budget need be addressed until then. He confirmed to Commissioner Aaronson that the current millage was 4.7815. Aaronson then made a motion to keep the maximum millage at 4.7815 and Commission Taylor seconded it.

Two members of the public spoke. Stella Jordan of the Town of South Palm Beach and a member of their town council, told the Commission that they were fortunate that valuations went up. She cautioned, however, that spending would be going up with this flat millage and that she would expect next year that millage be reduced. Alex Larson said she was glad that the Commissioners were not going to raise the millage rate. But she said was that what their constituents really needed from the Commission and the School Board and all the governments was to lower tax rates.

Back to the Board – Commissioner Burdick questioned the amount actually available for additional spending – which after some clarification, was $800K. Kudos to Mrs. Burdick for suggesting that perhaps in September the Commission could establish a precedent for taking half of any overage and using it to rollback rates for the taxpayer. There will be pressures on the Commission to spend to the limit. We hope that they decide, instead, to give some, if not all, back to the tax-payers.

The July Budget Package – What Has Changed?

On Tuesday, July 10, the Commissioners will set the proposed maximum millage rate based on the July budget package prepared by staff, which recommends keeping the county-wide millage flat at 4.7815.

The agenda item will be discussed on Tuesday, July 10, at 2:15pm (time certain) in the county building at 301 N. Olive, WPB.

This rate is an improvement over the small increase in millage that was proposed in June, reflecting increased valuation estimates from the Property Appraiser.

Is this really an improvement over the June package as a whole? What about compared to last year?

We have opposed millage increases in the past as the valuations were decreasing, with the goal of seeing county spending return to levels that are sustainable as measured by population and inflation. Compared to 2003, the ad-valorem equivalent budget has approached the so-called “TABOR” line, but with valuations bottoming out, we begin a new phase where rising valuations should be accompanied by declining millage rates.

The following table compares millage, proposed tax and ad-valorem equivalent spending between the 2012 budget, the June package and this July package:

| 2012 Budget | June Package | July Package | Net Change from 2012 | |

|---|---|---|---|---|

| County-Wide | ||||

| Millage | 4.7815 | 4.7984 | 4.7815 | 0 |

| Proposed Tax | $595,388,733 | $599,257,607 | $599,618,457 | + $4.2M (0.7%) |

| Fire Rescue | ||||

| Millage | 3.4581 | 3.4581 | 3.4581 | 0 |

| Proposed Tax | $175,610,575 | $176,358,065 | $177,006,499 | + $1.4M (0.8%) |

| Ad-Valorem Equivalent | ||||

| County Wide | $280M | $283M | $284M | + $3.9M (+1.4%) |

| Library & F/R | $228M | $229M | $230M | + $1.8M (0.8%) |

| Judicial & Other | $5.1M | $4.8M | $4.9M | – .2M (-4%) |

| Sheriff & Const. | $439M | $444M | $444M | + $5M (1.2%) |

| Total | $952.1M | $960.7M | $962.6M | + $10.5M (1.1%) |

As you can see from the table, compared to June, the millage is less but the proposed tax is slightly higher. Compared to 2012, the proposed tax is $4.2M higher county-wide and $1.4M in Fire Rescue. But the biggest difference is on the spending side of the equation, with Ad Valorem Equivalent rising $10.5M over 2012, half of that at PBSO.

So here is our net:

TAB View of 2013 County Budget Proposal

In preparation for the first budget workshop of the 2013 cycle next week, the county has published their proposal. The workshop will be held on Tuesday, June 12 at 6:00pm in the county building at 301 N. Olive, WPB.

Unlike the last few years which Administrator Weisman has called “the most difficult budget year the county has faced”, bottoming valuations have created a less austere outlook. With the expectation of a barely perceptible 0.39% drop in property values reported by Property Appraiser Gary Nikolits, (See: Has free-falling Palm Beach County real estate finally hit bottom? ) the days of trying to save programs and spending levels by big hikes in the tax rate may be coming to an end.

The county proposal is therefore modest – a 0.4% hike in the county-wide millage rate to 4.7984 (up from 4.7815 last year), and a 0.6% or $3.9M hike of taxes collected. There are no projected cuts to “vocal constituent” programs like the nature centers, lifeguards or Palm Tran Connection, and even though the Sheriff is asking for an increase of $4.7M in ad-valorem revenue and $8.8M in appropriation, it is mitigated somewhat from a “return of excess fees” of $10M.

What had been expected to be a $15-30M problem this year, was positively affected by smaller than expected costs associated with FRS, and the use of “one-time” sources such as sweeping funds from Risk Management, capital project and Fleet Management reserves. Given TAB’s emphasis last year on using reserves to cover shortfalls in the difficult times, we are glad to see this development.

The entire proposal is good news, considering how hard everyone worked last year to bring the initial proposal (3.6% increase in rates) down to the final 0.6%. Although we think that it would be an appropriate gesture for the board to keep the millage flat (at a cost of the $3.9M hike), as they are doing with the Library and Fire/Rescue MSTUs, if this proposal was approved as submitted we would not object.

That said, there are some cautionary statements in the proposal. It is mentioned that 35 positions (half of them filled) will be eliminated without a service impact, by various good management practices and the expiration of grant funding of temporary positions. It is also stated that general county employees have not received a raise since 2008. There is also interest in some quarters to increase spending on some programs.

We ask that the commissioners not try to address these things in this budget year. The private economy has not yet fully recovered, even if property values are leveling off. Consequently, we call on TAB partners and supporters to stay vigilant, attend the budget meetings, and let your commissioners know you don’t support any increases above the submitted proposal.

For the Post’s view of the proposal, see: County budget proposal: less gloom and doom

BCC to Discuss $29M in Spending Reductions

At the Tuesday, May 15 Commission Meeting, agenda items 5a2 and 5a3 deal with an “efficiency audit” performed by consultants Gerstle, Rosen & Goldenberg at the request of county administration.

The audit found areas of significant savings, both in county operations and in the constitutional offices (except the Sheriff who evidently refused to answer any of their questions), estimated in the range of $29M. They looked in four areas: operating efficiencies, outsourcing, staff reductions, and additional sources of revenue. (It appears that only the outsourcing will be discussed in 5a2, and 5a3 addresses efficiencies regarding the constitutional offices).

These savings involve the elimination of 921 positions, mostly through outsourcing, and the bulk of the savings comes from reduction in benefit obligations.

With the county facing a potential $15M shortfall in the 2013 budget to be discussed at the first workshop on June 12, searching for areas to reduce spending is sorely needed and this study is an excellent move in that direction. Staff should be commended for both commissioning the study and for bringing it to the board for direction.

We are not overly optimistic that this initiative will be warmly embraced however. Already, the counter-arguments have begun. Chairman Vana says “My goal was never to try to get rid of a million people”. OFMB Director Bloesser warns that “it was unlikely that many of the findings could be put into effect before the budget year begins on Oct. 1”. Clerk Bock says that the proposed savings in her office are “incorrect and irresponsible”.

Nevertheless, this is the kind of direction that TAB has been calling for for several years, and we ask partners and supporters of TAB to attend the Tuesday session in support of the consultants proposals, or communicate your views to your commissioner.

The full content of the report can be found in the attachment for item 5a2 and the initial reactions are captured in the Palm Beach Post: Consultant: Palm Beach County can save $32M with 1,000 job cuts, add $3M with rate hike.

TAB Opposes Sales Tax Increase

Staff requests direction on implementation of a “Charter County and Regional Transportation Tax”

On Tuesday, May 1st, the Palm Beach County Commission will be considering a $100 Million, 1/2% increase (raising existing 6% to 6.5%) in the sales tax to fund transportation related spending. The Administrator is requesting board feedback on putting this proposed tax on the November ballot, and the Commission must give approval prior to the August 10th ballot language deadline. A good description can be found in Jennifer Sorentrue’s article Palm Beach County voters may be asked to increase sales tax by half-cent for roads, transportation.

The agenda item is 4A2 – and it falls early in the morning’s schedule – after special presentations and the Consent Agenda, and an item related to the Supervisor of Elections. The agenda can be found here and the agenda item background here.

The County Administrator’s rationale is as follows:

Why now? Is it because our economy languishes and home values aren’t increasing significantly so there are revenue pressures? Is it because the price of gas has become so high that we – tourist and resident alike, are driving less or boating less? Is it because the administration doesn’t want to have to account for how they spend – when they have no productivity and performance benchmarks nor measurements against those benchmarks?

TAB has issues with this proposed sales tax increase:

Background:

Residents, business owners and tourists alike pay ad valorem taxes. The resident or business owner pays it directly. The ‘tourist’ pays it indirectly. Residents, businesses and tourists pay for fuel. The Palm Beach County Revenue Manual lists several taxes that are geared towards transportation already:

In addition – Palm Tran already has fees, and builders have ‘road’ impact fees.

At the April 27, 2012 Commissioners’ workshop on the Internal Audit Department, the Commissioners, whether rhetorically or not, questioned the lack of any kind of productivity or performance measurements in the county. Asking the voters’ to hand over more of their hard-earned money to an open-ended, unspecific, windfall tax is unconscionable.

Voters are unlikely to approve the proposed ballot amendment. Please tell your commissioners to reject this request by the County Administration and not put it on the ballot in November.